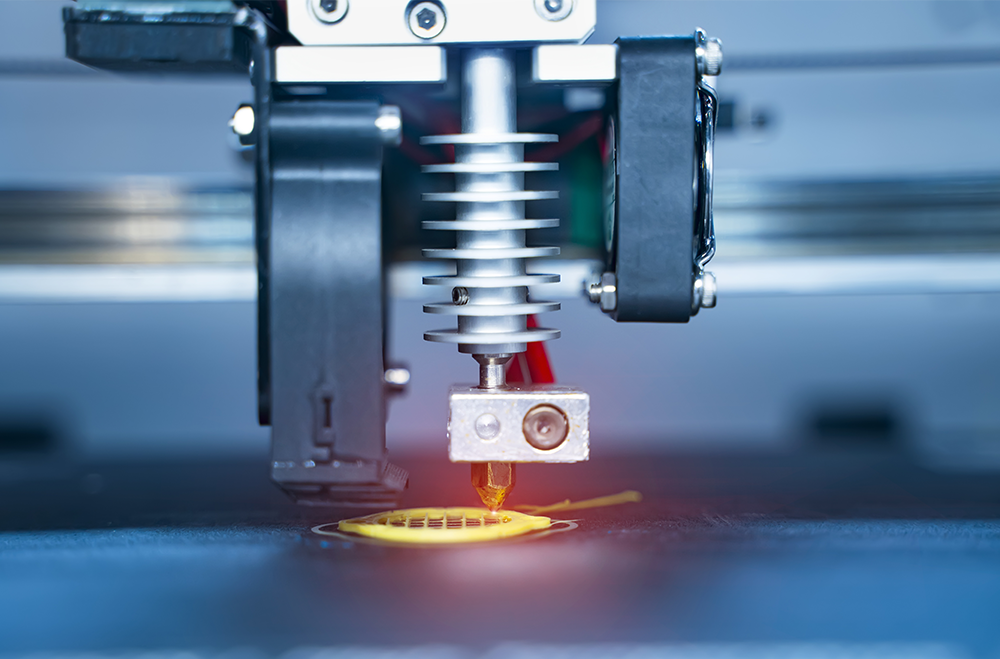

GIS, based in Cambridge, UK, is a leading developer and supplier of high-performance control electronics, software, and ink delivery systems. Founded in 2006, the company is well known for inventing and delivering state-of-the-art 2D and 3D printing inkjet hardware and unique operating software. GIS has more than 130 customers around the world with a focus on high-value, precision-oriented applications such as specialised direct-to-container packaging, printed electronics functional fluids and 3D printing, which can all be controlled by the proprietary software system – Atlas.

Nano Dimension is a NASDAQ-listed industry leader in Additively Manufactured Electronics / 3D-Printed Electronics and Micro Additive Manufacturing whose vision is to provide advanced, digital production technologies for additive manufacturing and 3D printed electronics that meet the speed and efficiency standards of Industry 4.0 fabrication demands.

Nano Dimension paid GIS shareholders $18.1 million in cash. In addition, it will pay between $1.3 million to $10.7 million within the next 27 months, if GIS achieves certain financial performance over this period.

“This is a win-win for both organisations,” stated Yoav Stern, Chairman and CEO of Nano Dimension. “Combining forces and resources will enable growth for the integrated company at an accelerated pace. This merger will upgrade Nano Dimension’s product line with GIS’ innovative hardware and software. In parallel, our go-to-market network will expand GIS’ commercial horizon and customer base. The combination of both companies will further leverage the customer-focused culture across the entire organisation.”

Nick Geddes, Founder and CEO, said:

“The Acuity Advisors team have been phenomenal in advising GIS on its recent sale to Nano Dimension. Their calmness under pressure as we sought to close the transaction in a shortened timeframe was notable along with their commitment to bring the deal to a conclusion in a way that was beneficial for all parties and our staff. They have a combination of many years of corporate finance experience and deep transactional technical expertise with the softer skills to resolve and agree contentious areas whilst preserving relationships. We would not have achieved our objectives and a rapid closing without their assistance – the breadth and depth of the team has been truly impressive and GIS is now well positioned to continue its exciting growth story.”

Matthew Byatt, Managing Partner at Acuity, said:

“It’s been a pleasure to work with GIS and Nano Dimension, two companies who are at the leading-edge of additive manufacturing and industrial printing technology. We wish Nick, Steve and the GIS team every success under new ownership and will be following the Nano Dimension story with interest. This transaction demonstrates Acuity’s leading position in the European industrial technology and software sectors and our reputation for working with the most innovative mid-market tech businesses.”

“The Acuity Advisors team have been phenomenal in advising GIS on its recent sale to Nano Dimension. Their calmness under pressure as we sought to close the transaction in a shortened timeframe was notable along with their commitment to bring the deal to a conclusion in a way that was beneficial for all parties and our staff. They have a combination of many years of corporate finance experience and deep transactional technical expertise with the softer skills to resolve and agree contentious areas whilst preserving relationships. We would not have achieved our objectives and a rapid closing without their assistance – the breadth and depth of the team has been truly impressive and GIS is now well positioned to continue its exciting growth story”

NICK GEDDES | Founder and CEO

Global Inkjet Systems